Price Targets vs Reality: Lessons for Traders and Investors

Explore the reliability of analyst price targets, show how they can be biased, reactive, and misleading compared to fundamentals like ratios and market trends. It uses Oracle, & Tesla as case studies.

In this podcast episode, Krish Palaniappan discusses the concept of price targets for securities, their reliability, and how they can influence investment decisions. He explores the differences between long-term and short-term investment strategies, the biases that can affect price targets, and the importance of careful analysis when making investment choices. The conversation also touches on the upcoming FinTech product being developed by Snowpal.

Takeaways

Price targets are assigned by analysts to various securities.

Understanding the difference between sector and industry is crucial.

Long-term investors may not care about current prices.

Day traders need to be aware of price fluctuations.

Price targets can be influenced by biases and conflicts of interest.

Investors should consider multiple metrics, not just price targets.

Market conditions can change rapidly, affecting price targets.

It's important to do due diligence before making investment decisions.

Dollar cost averaging can mitigate risks in investing.

The upcoming FinTech product aims to address gaps in trading tools.

Podcast

Summary

Introduction

Main topic: price targets for securities and their reliability.

Personal context: Snowpal is beginning work on a new FinTech product.

Invitation for collaboration from potential partners or investors.

Understanding Price Targets

Price targets are set by analysts on Wall Street for securities like NVIDIA, Apple, Amazon, Oracle.

Different platforms show varying numbers:

MarketWatch: High $410, Low $208, Median $350, Avg $336.

TipRanks: Avg $340, High $410, Low $208.

Analysts like Barclays, Bank of America provide multiple targets ($306, $368, $400, etc.).

Investing Perspectives

Long-term investors: May not care about short-term fluctuations (holding for years/decades).

Short-term or active traders: Need better timing and attention to entry points.

Debate: “Time in the market” vs. “timing the market.”

Dollar-cost averaging suggested as a prudent strategy.

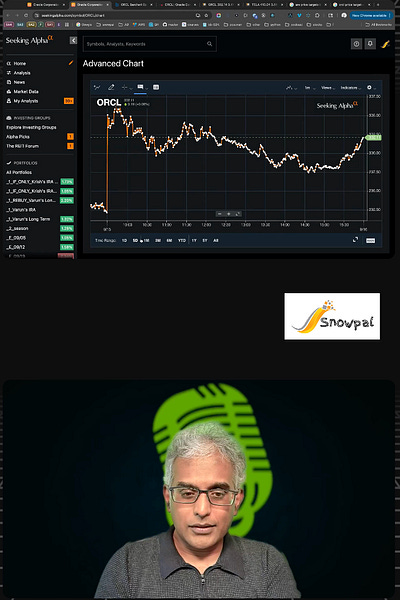

Case Study: Oracle

Oracle stock example:

Price swing after earnings: From ~$241 to ~$345 (40% increase).

Year-to-date: Up ~75% (at one point ~100%).

Day trading Oracle: Intraday moves (306 → 298 → recovery to 303).

Importance of precision for day traders (every cent matters).

Case Study: Microsoft

Microsoft example:

Jan 2024: $388 → Mar 2025: $391.

Essentially flat for 14 months.

Meanwhile, NASDAQ rose 20% in same window.

Lesson: Even strong companies can stagnate vs. broader market.

Analyst Bias & Price Target Limitations

Price targets are often biased and have limited predictive power.

Reasons:

Conflicts of interest (banks/brokerages benefit from positive ratings).

Marketing pressure (analysts prefer “buy” over “sell”).

Recency bias (targets adjusted upward after rallies).

Example: Oracle’s targets rapidly updated after big earnings spike.

Macro Factors & Market Sensitivity

Example: Upcoming rate cut decision.

Market expected 25 bps cut—any deviation could cause sharp volatility.

Price targets shift frequently based on such macro events.

Ratios vs. Price Targets

Better to rely on fundamental ratios (P/E, forward P/E, PEG, etc.) than blindly on price targets.

Ratios also need context, as forward estimates are speculative.

Price targets can be useful reference points but not standalone decision drivers.

Case Study: Tesla

Tesla’s low-end price targets historically absurdly low ($19–$50 vs $400+ stock price).

If investors avoided Tesla based on low targets, they would regret it.

Ratios (Forward P/E 233 for Tesla, 266 for Palantir) show challenges but must be part of a collective evaluation.

Emphasis: Investment is a mix of art and science.

Final Thoughts & Closing

Price targets can mislead if taken at face value.

Investors should balance them with ratios, trends, and personal strategy.

Many retail investors still rely heavily on analyst ratings.

Example: The Trade Desk—recent downgrade despite price targets suggesting upside.

Closing note: Invitation to collaborate with Snowpal on upcoming FinTech product.