NASDAQ’s Spring Rally: A 3.5-Month Climb Through Volatility and AI Hype

NASDAQ’s nearly 20% rise from April to mid-July, examining daily volatility, post-Liberation Day recovery, and the role of AI-fueled optimism. It also compares today’s tech rally with the 1999 bubble.

In this podcast, Krish Palaniappan discusses the recent performance of the NASDAQ, analyzing market trends, volatility, and the impact of AI on trading. He provides insights into historical comparisons, daily fluctuations, and potential investment opportunities, while also addressing the current market sentiment and future predictions.

Takeaways

Trading involves significant risk and should be approached cautiously.

NASDAQ has shown a remarkable increase of nearly 20% in the last three months.

The current AI frenzy is being compared to the 1999 tech bubble, but with more solid earnings.

Two-thirds of the last three months have seen positive market days for NASDAQ.

Increased trading activity has benefited brokerage firms significantly.

Investing right after market dips can lead to substantial gains.

Market volatility has calmed down recently, indicating potential stability.

NVIDIA's stock has surged by 55% in the last three months, showcasing tech growth.

The market is currently on an upward trend, but caution is advised.

A healthy market correction may be on the horizon, which could be beneficial.

Podcast

Summary

Here is a sectional breakdown of the podcast.

1. Introduction & Disclaimer

Opening remarks

Disclaimer: Not financial advice, seek licensed advisors

Scope of episode: NASDAQ’s performance from April 1 to July 17 (~3.5 months)

2. Market Context & Timeframe

Clarifies “Liberation Day” (April 2)

Review period: April 1 to July 17 (~70–73 trading days)

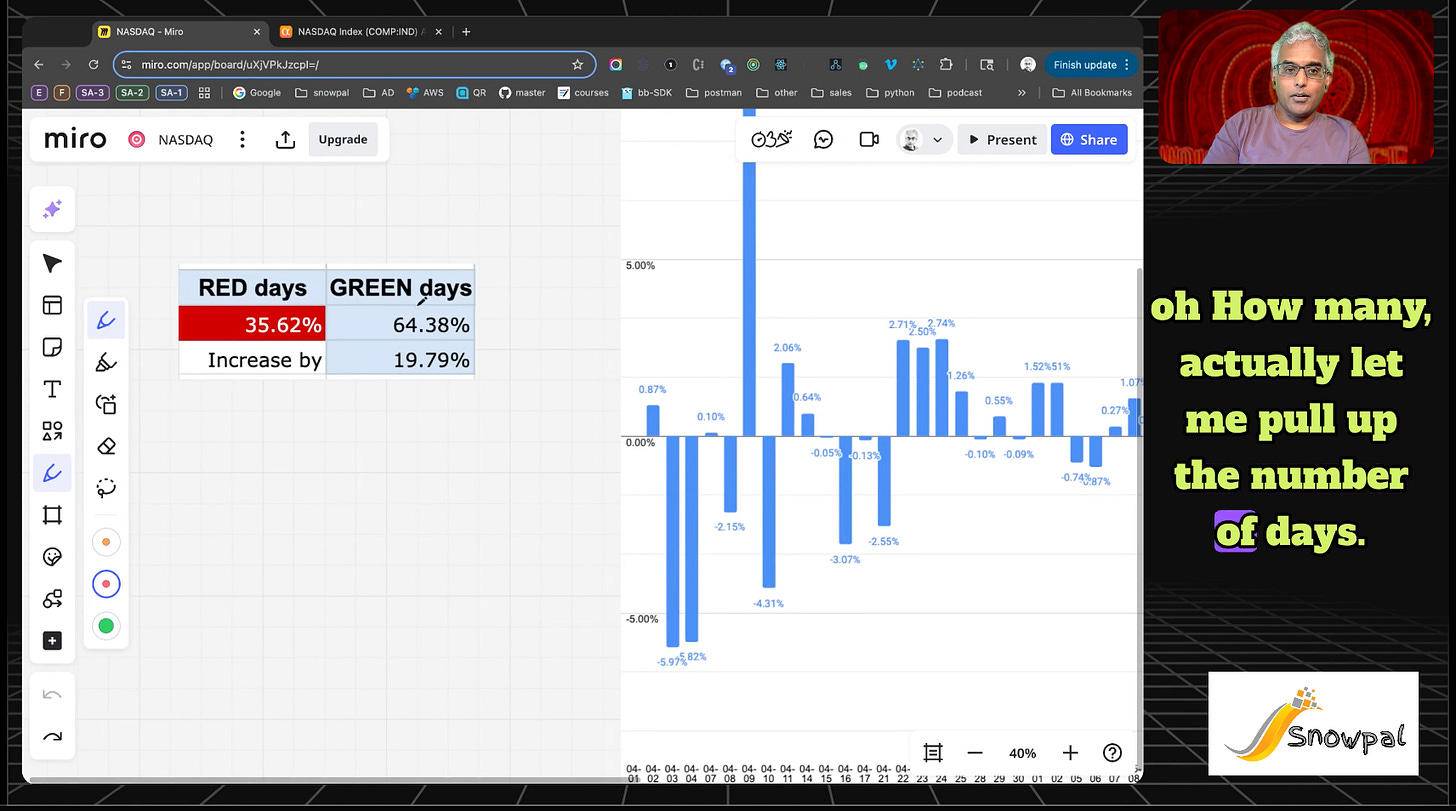

Breakdown: ~35% red days, ~65% green days

Comparison with year-to-date (YTD) performance

3. Performance Analysis

April 1 NASDAQ value: ~17,449

July 17 NASDAQ value: ~20,878

Approximate gain: +20% over 3.5 months

Year-to-date gain: ~8%

Q1 performance: ~-11%

Q2 and Q3 recovery: Significant rebound and growth

4. Historical Perspective & Comparisons

10-year average NASDAQ return: ~15% annually

Compares current AI-driven momentum to 1999 tech bubble

Highlights differences: EPS, revenue backing vs. 1999 hype

RSI nearing 80 (overbought territory)

5. Volatility Snapshot

Post-Liberation Day plunge: ~14% drop in 3 days

Quick rebound of ~12% in following days

Strong correlation between market volatility and earnings season

Brokerage earnings (e.g., Interactive Brokers, Schwab) benefited from trading activity

6. Daily Trends & Patterns

Volatility clusters observed across April to mid-May

Visual patterning: clusters of gains and losses

Shift after May 15 toward more stable upward movement

June 23 to July 17: ~6% increase in ~3 weeks

7. Stock-Specific Highlights

NVIDIA: 55% increase since April ($4.2 trillion market cap)

Meta: Also strong gains

Vertiv: Almost 100% increase

Broader tech strength aligning with NASDAQ trajectory

8. Forward-Looking Views

Prediction: Market might move sideways or experience a healthy correction

Encourages viewers to share their own outlook

Promotes upcoming affordable course on AI’s impact on markets

9. Closing Thoughts

Summary of insights

Call for feedback and engagement

Sign-off