Datadog vs. CoreWeave: Two Software Companies, Two Very Different Market Stories

Datadog is a mature observability company trading well below recent highs, while CoreWeave is a volatile, AI-driven infrastructure stock favored by momentum-focused investors.

Disclaimer: This article is for educational purposes only and does not constitute financial advice.

In a market dominated by AI narratives and software-driven growth, it’s easy to lump technology companies into a single bucket. But a closer look often reveals very different stories beneath the surface. Two companies that highlight this contrast particularly well are Datadog (DDOG) and CoreWeave (CRWV)—both high-quality software businesses, yet operating in entirely different domains and exhibiting sharply different market behavior.

This article explores what these companies do, how they’ve been performing in the public markets, and why their recent price action is worth paying attention to.

Podcast

Observability vs. AI Infrastructure: Datadog and CoreWeave Compared — on Apple and Spotify.

Company Overview: Complementary, Not Competitive

Datadog: Observability at Scale

Datadog is a well-established observability platform used by engineering teams to monitor infrastructure, applications, logs, and performance. It competes with companies like New Relic and Dynatrace, but has emerged as a favorite among many practitioners due to its product depth, ecosystem integrations, and developer experience.

Datadog has been public since 2019 and has built a strong presence across cloud-native organizations. It is not a cheap product, but for teams that understand how to use it efficiently, it delivers substantial operational value.

CoreWeave: GPU Infrastructure for the AI Era

CoreWeave is a much newer public company, having gone public in early 2025. It operates as a specialized cloud provider focused on GPU infrastructure, primarily serving companies building AI and machine learning workloads.

Rather than competing with hyperscalers head-on, CoreWeave positions itself as a high-performance, AI-first infrastructure provider. As demand for AI compute has surged, CoreWeave has ridden that wave aggressively—both operationally and in the public markets.

Market Capitalization and Pricing Snapshot

At the time of analysis:

Datadog

Share price: ~$119

Market cap: ~$40B

CoreWeave

Share price: ~$101

Market cap: ~$50B

Despite Datadog being public for much longer, CoreWeave’s market capitalization has already surpassed it—largely reflecting investor enthusiasm around AI infrastructure.

Datadog: Strong Business, Recent Market Weakness

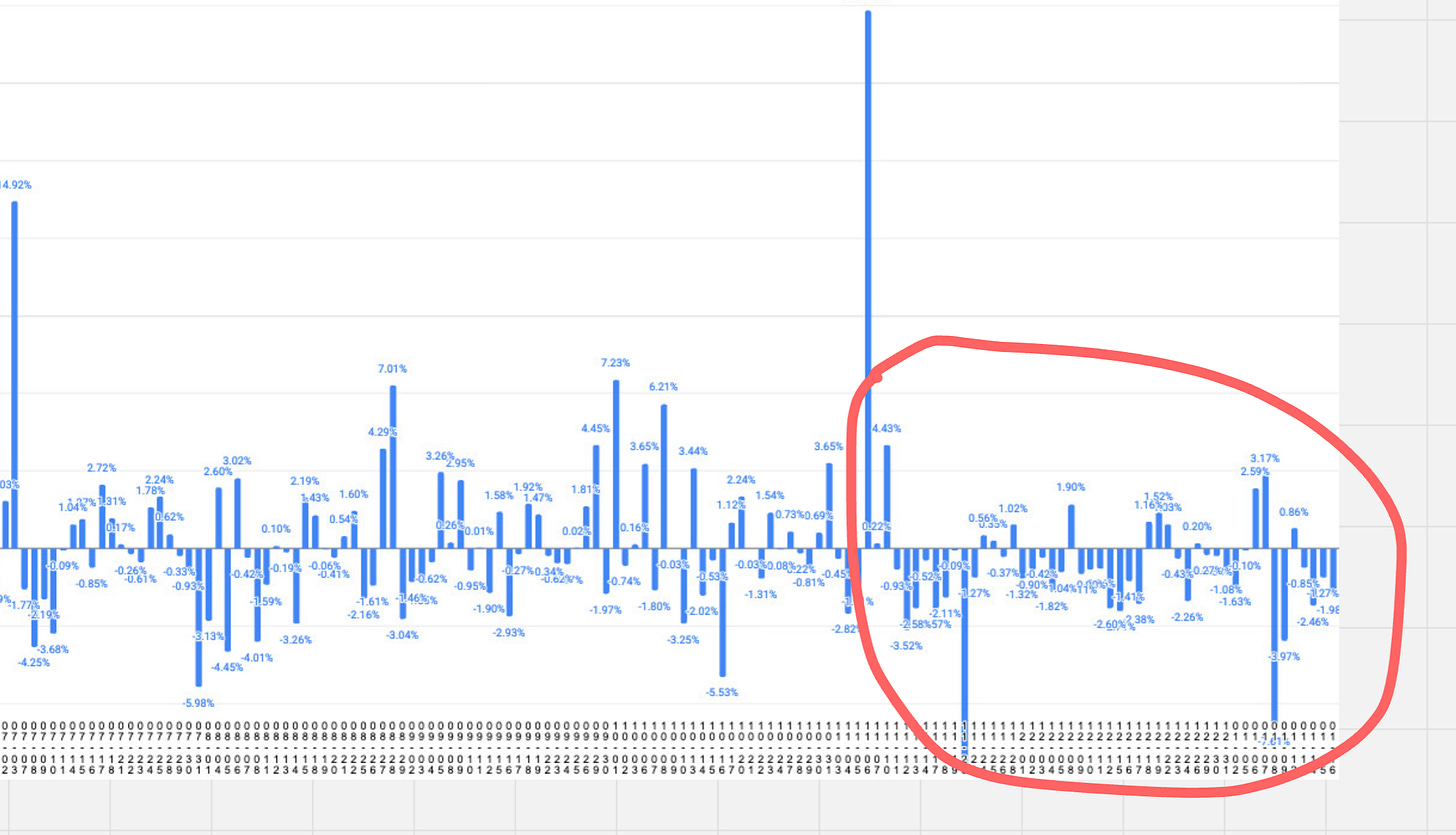

Looking at Datadog’s price action over the last 12 months reveals a notable trend:

Datadog peaked near $200 in early November.

Since then, the stock has declined roughly 40% in about two months.

Many recent trading days have been negative, including several large down days.

Interestingly, this decline followed what appeared to be a strong earnings report. Datadog surged more than 20% on earnings in early November, briefly approaching its 52-week high before reversing course sharply.

Trading Volume Insights

Datadog’s average daily trading volume typically ranges between 3–6 million shares, with occasional spikes—most notably when it was added to the S&P 500. Compared to more speculative names, Datadog trades with relatively moderate volume.

Valuation Context

Datadog’s forward P/E ratio sits around 60, which is high in absolute terms but modest compared to other growth-oriented software companies. Valuation alone doesn’t explain the recent drawdown, suggesting broader market sentiment or rotation rather than company-specific fundamentals.

CoreWeave: Volatility, Momentum, and AI Tailwinds

CoreWeave tells a very different story.

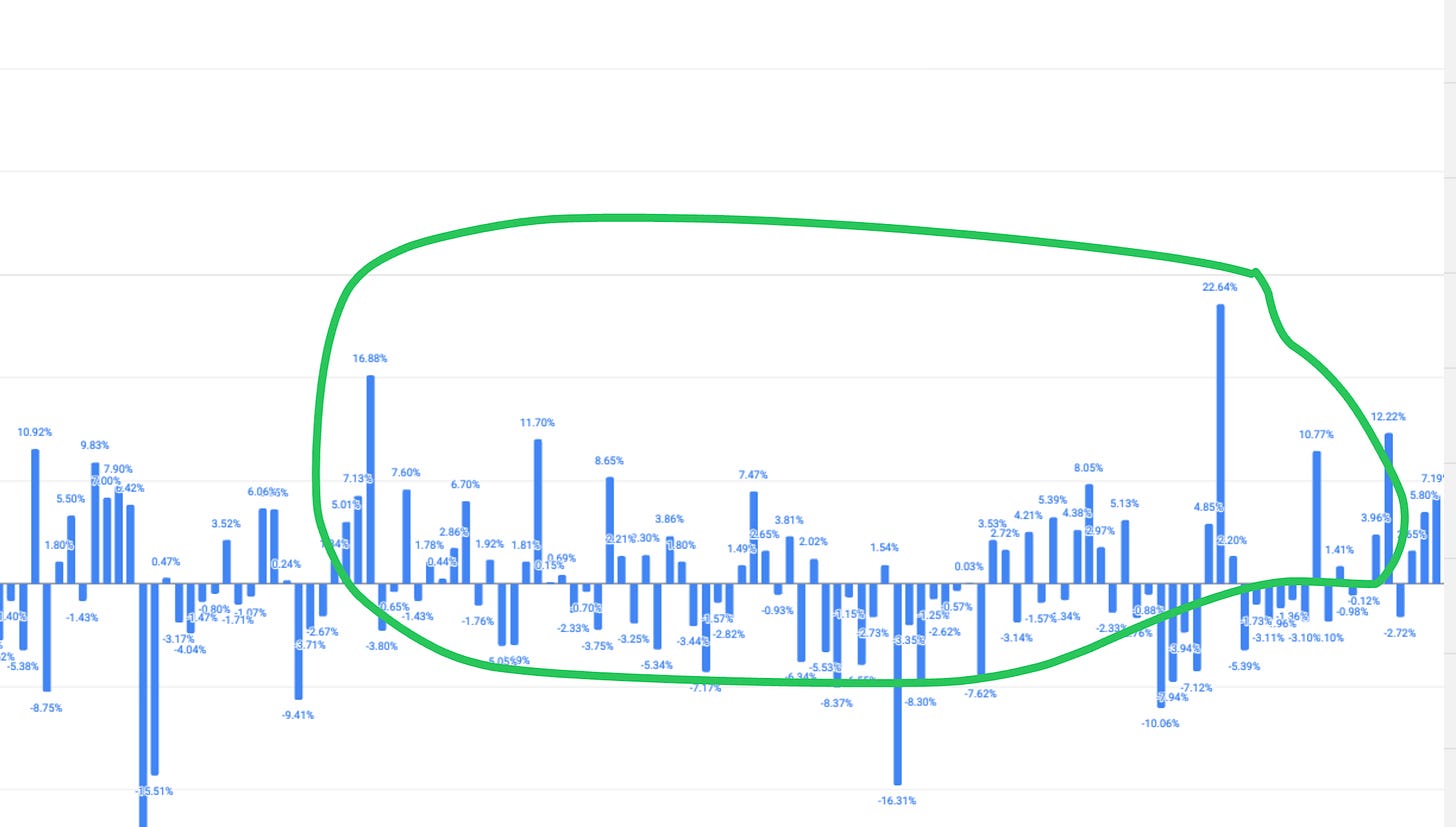

IPO price: ~$40

Current price: ~$100+

Gain since IPO: ~150% in under a year

CoreWeave has become a highly volatile, high-momentum security:

Large up days of 10–20%+ are common.

Large down days are equally frequent.

Overall trend since IPO remains strongly positive.

Trading Volume

CoreWeave trades at an average daily volume of roughly 25–30 million shares, nearly 10x Datadog’s volume. This level of liquidity and volatility makes it particularly attractive to active traders and short-term investors.

Profitability

Unlike Datadog, CoreWeave is not currently profitable, reinvesting heavily into infrastructure expansion. Traditional valuation metrics such as P/E are less meaningful here, as the stock trades primarily on growth expectations and AI momentum.

Volatility Profiles: Know What You’re Signing Up For

Datadog

Lower volatility (relative to CoreWeave)

Established business

Recent sharp drawdown may interest long-term investors

CoreWeave

Extremely volatile

Strong correlation with AI-related sentiment

Better suited for traders or investors comfortable with large price swings

Investors who dislike volatility may find CoreWeave uncomfortable, while those seeking high-beta exposure to AI infrastructure may find it compelling.

Why This Analysis Is Harder Than It Should Be

One key takeaway from this comparison is how time-consuming it is to assemble even basic insights:

Tracking daily price movements

Comparing volume trends

Identifying up-day vs. down-day distributions

Understanding historical context

Despite the abundance of market tools, extracting actionable insights still requires significant manual effort. This is one of the motivations behind building fintech APIs that can surface these patterns quickly and contextually—especially for day traders and active investors, where time literally translates into money.

Final Thoughts

Datadog and CoreWeave represent two excellent software companies operating in very different phases of their lifecycle:

Datadog looks increasingly interesting from a pricing perspective after a sharp pullback.

CoreWeave remains a momentum-driven, AI-linked stock with substantial volatility and upside—but also risk.

Neither is inherently “better” than the other; they simply serve different investor profiles and strategies. Understanding those differences is far more important than chasing headlines.

As always, paper trading, risk management, and independent research remain essential—especially in markets this dynamic.