Apple and Google’s Gemini Deal: What It Means for Siri, Smartphones, and the Future of AI

Apple’s multi-year deal to power Siri with Google’s Gemini models signals a major shift in mobile AI, positioning Google’s technology at the core of both Android and iPhone ecosystems.

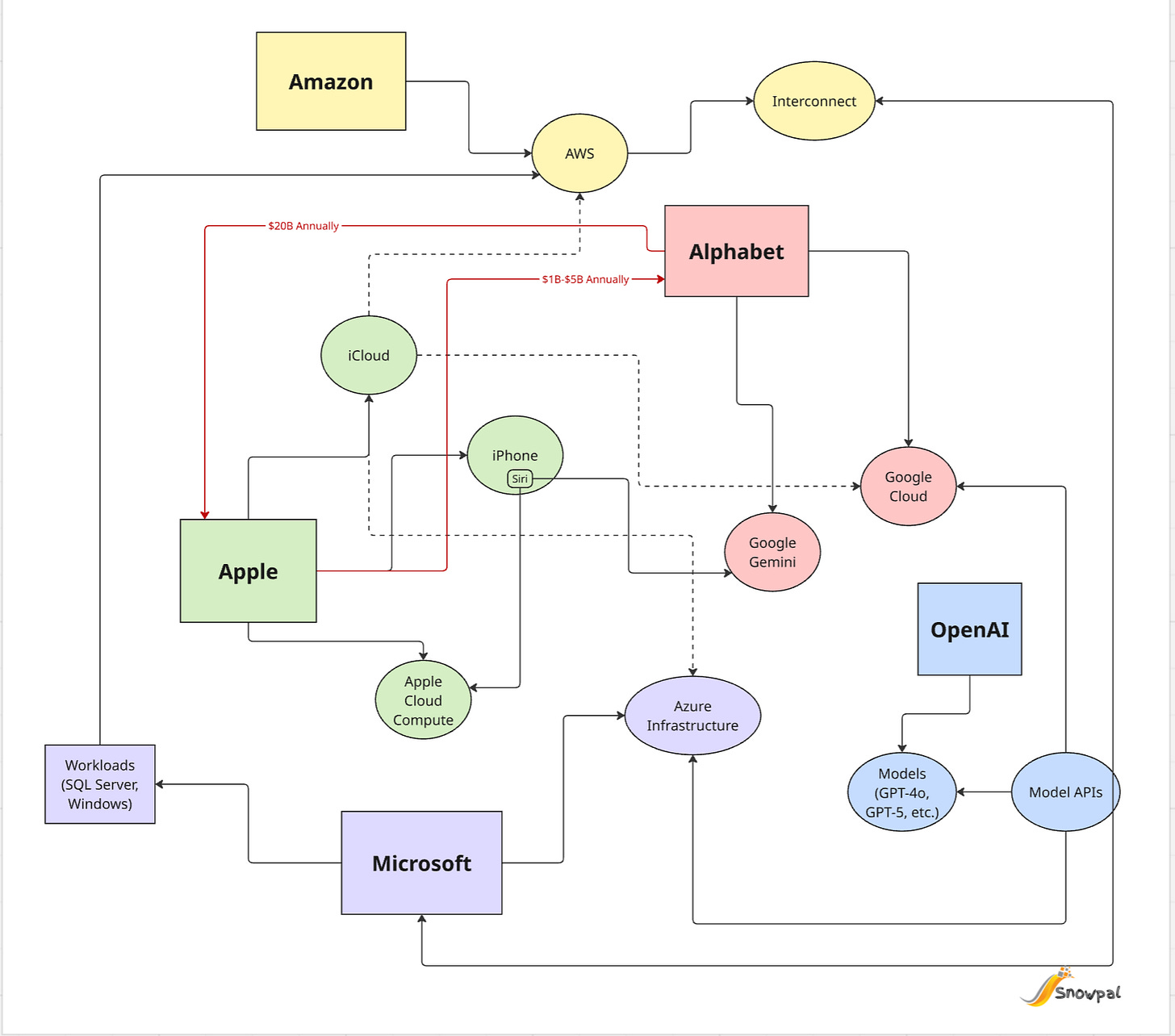

Earlier this month, Apple and Google announced a major multi-year partnership that will bring Google’s Gemini AI models into Apple’s ecosystem, most notably to power Siri. The deal signals a profound shift in how the world’s most influential consumer technology company approaches artificial intelligence and raises important questions about competition, platform control, and the future of mobile computing.

Podcast

Apple, Google, and the Battle for the AI Layer of Smartphones - on Apple and Spotify.

Summary

Apple’s decision to power Siri with Google’s Gemini AI models marks a major turning point in mobile AI. For the first time, Apple is relying on a direct competitor to supply the intelligence layer of its most important product—the iPhone—signaling how far ahead Google has moved in large-scale AI models.

Financially, the deal could cost Apple up to $5 billion per year, while deepening Google’s reach across mobile devices worldwide. With Gemini already powering assistants on most Android phones, Google’s AI may soon sit behind the majority of smartphones on the planet, including iPhones.

In the short term, Apple gains faster AI progress and improved Siri capabilities. In the long term, the partnership raises bigger questions about platform dependence, competition with OpenAI, and who ultimately controls the AI layer that will define the future of consumer computing.

Why This Deal Matters

For decades, Apple has been known for vertical integration: controlling hardware, software, and user experience end-to-end. That is why this partnership stands out. Apple is now relying on another software giant—Alphabet (Google’s parent company)—for a core intelligence layer of its flagship product.

The integration is expected to focus primarily on Siri on the iPhone, which alone accounts for close to half of Apple’s total revenue, making the quality and competitiveness of Siri strategically critical.

In simple terms:

Product layer: iPhone

Assistant layer: Siri

AI model layer: Google Gemini (from Alphabet)

This stack formalizes Google’s role deep inside Apple’s most valuable product line.

The Economics: Billions of Dollars Per Year

Industry estimates suggest Apple will pay Alphabet between $1 billion and $5 billion annually for access to Gemini models, with $5 billion often cited as a likely upper bound.

If the higher figure holds:

Apple incurs $5B/year in new costs.

Alphabet gains $5B/year in new revenue from this single partnership.

This financial relationship is layered on top of an already massive one: Google pays Apple roughly $20B per year to remain the default search engine on iPhones. After accounting for Siri/Gemini payments, Alphabet would still net about $15B annually from its commercial relationship with Apple.

From Apple’s perspective, $5B represents several percentage points of annual net income—far from trivial for a company known for protecting its margins.

Privacy and Infrastructure: Apple Private Cloud Compute

Apple has indicated that Gemini-powered Siri requests will run inside Apple’s own “Private Cloud Compute” infrastructure, preserving its security and privacy guarantees even while using Google’s models.

In effect:

Gemini provides the intelligence.

Apple controls the execution environment and data handling.

This hybrid approach allows Apple to maintain its privacy narrative while accelerating its AI capabilities.

The Global Smartphone Context

To understand the strategic implications, it helps to look at market structure:

Apple’s global smartphone share: ~20%

Android’s global share: ~75–80%

In India specifically, Apple holds under 2% of the total phone market, while 98% run Android.

Android, though open source, is owned and governed by Alphabet, giving Google enormous leverage over global mobile software distribution.

A Deeper Shift: Gemini Everywhere

The partnership becomes more significant when combined with another reality:

The Gemini family of models already powers the primary “Siri-equivalent” assistants on many Android devices.

This means Gemini is likely to power:

Voice assistants on most Android phones, and now

Siri on iPhones

In effect, Google’s AI models may soon sit at the center of the majority of the world’s smartphones.

That concentration raises strategic and regulatory questions about AI platform dominance.

Competition with OpenAI

This move also reshapes the competitive landscape:

OpenAI focuses heavily on consumer-facing AI products like ChatGPT, working closely with Microsoft.

Google, by contrast, controls a vast ecosystem: Search, YouTube, Android, Google Cloud, and now potentially Siri’s intelligence layer.

Google’s AI strategy is both consumer (B2C) and enterprise (B2B) oriented, which gives it scale advantages that are difficult to replicate.

The result is a two-giant race:

OpenAI + Microsoft on one side

Google + its platform empire on the other

Why Apple Didn’t Build This Themselves

Apple has historically outsourced strategically—most notably:

Using Google Search by default.

Previously relying on Intel for Mac processors before moving to Apple Silicon.

So partnering is not new. But AI is different: it underpins user experience, product differentiation, and future software platforms.

Apple now faces a strategic dilemma:

Short term: Buy best-in-class AI (Gemini) to stay competitive.

Long term: Either build its own models or risk permanent dependency on a direct competitor.

Given how fast AI models evolve and how capital-intensive they are, catching up may take years.

What Comes Next?

Several scenarios are plausible:

Temporary partnership: Apple uses Gemini while developing in-house models.

Long-term dependency: Apple treats AI like search—outsourced indefinitely.

Multi-vendor strategy: Apple partners with both Google and OpenAI to avoid single-vendor risk.

Vertical reintegration: Apple eventually replaces Gemini with proprietary models.

Each path reshapes the balance of power in consumer technology.

Final Thoughts

This deal is not just about improving Siri.

It is about:

Control over the intelligence layer of smartphones

The economics of AI infrastructure

Platform dominance in a world where assistants become the primary user interface

If Gemini ends up powering most Android phones and iPhones, Google may quietly become the most influential AI platform provider on Earth—operating behind competitors’ logos.

For Apple, the partnership buys time. For Google, it buys reach. And for the rest of the industry, it marks the beginning of a new phase where AI models matter as much as operating systems once did.