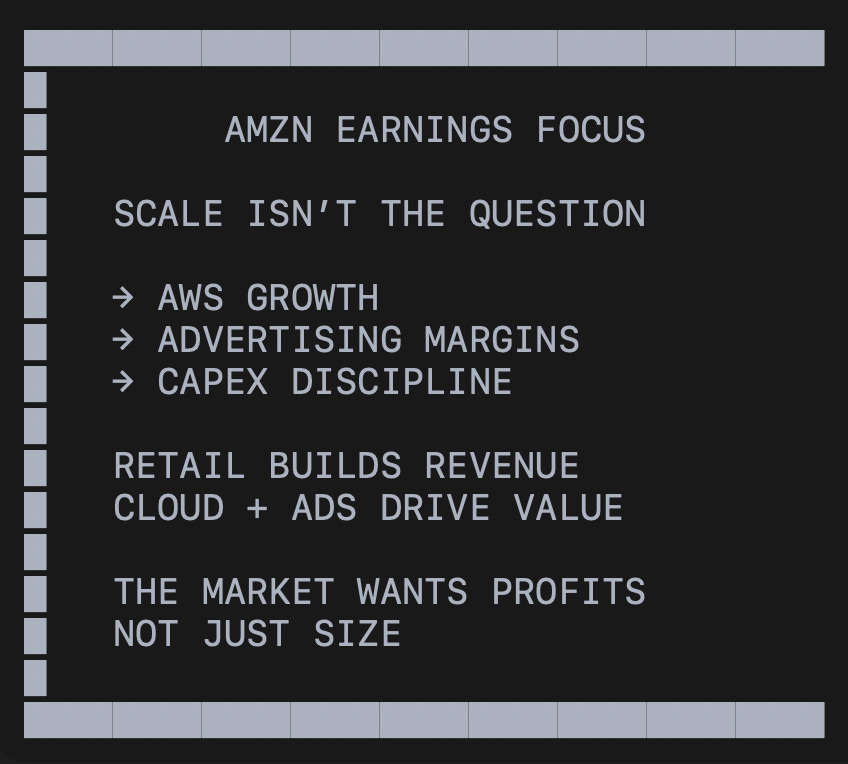

AMZN Ahead of Earnings: Can AWS and Ads Reignite Confidence?

Amazon’s earnings hinge on AWS growth, advertising margins, and capex discipline. Retail scale alone won’t lift AMZN; investors want proof high-margin engines can reaccelerate amid cloud competition.

With earnings season in full swing, several mega-cap technology stocks have underperformed broader indices over the past year. Despite strong index-level gains, many household names have struggled to keep pace, raising questions about growth durability, margins, and capital allocation—especially in cloud computing, AI infrastructure, and advertising.

Podcast

Market Context and Earnings Focus — on Apple and Spotify.

Amazon (AMZN)

And as earnings season unfolds, few companies face more scrutiny than Amazon. Despite generating nearly $700 billion in annual revenue and sitting at the center of global commerce and cloud infrastructure, Amazon’s stock has underperformed the broader market over the past year. The issue isn’t size or relevance—it’s whether Amazon can prove that its most profitable engines are still accelerating.

At the core of the investment thesis remains AWS. While cloud represents less than 20% of Amazon’s total revenue, it contributes a disproportionate share of operating income thanks to margins in the mid-30% range. Investors are watching closely to see whether AWS growth can remain in the low-to-mid 20% range as competition from Azure and Google Cloud intensifies. Any sign of deceleration would raise concerns, while stabilization or reacceleration could meaningfully shift sentiment.

Advertising is the second critical lever. Now approaching roughly 10% of total revenue, Amazon’s ad business carries margins that may exceed 50%, making it one of the most valuable growth drivers in the entire company. Continued expansion here has an outsized impact on earnings, especially as retail margins remain thin. E-commerce still generates the bulk of revenue, but profitability there is structurally limited, reinforcing why AWS and advertising matter far more to valuation than topline retail growth.

Capital allocation is the final variable. Amazon’s push into custom silicon—such as Trainium—is designed to improve long-term AWS margins by reducing dependence on third-party chips. However, elevated capital expenditures without clear near-term returns remain a risk in a market that has grown increasingly intolerant of margin compression. With the stock well below recent highs, guidance around capex discipline may matter as much as reported results.

In short, Amazon doesn’t need to prove demand exists—it needs to prove that high-margin growth can persist. Earnings will be judged less on beats or misses and more on AWS momentum, advertising strength, and confidence in margin expansion.

Other Hyperscalers

Let’s take a quick look at some of the other big names.

Meta Platforms (META)

Meta Platforms has also lagged broader market performance, with its stock down roughly 3–4% over the last year. Despite strong engagement across its platforms, Meta’s share price reflects investor caution around ad growth sustainability and heavy spending on AI and infrastructure. Like Amazon, Meta’s results highlight the growing gap between headline revenue strength and market expectations for margin discipline and capital efficiency.

Microsoft (MSFT)

Microsoft experienced a sharp post-earnings sell-off after missing expectations by roughly 1%, demonstrating how unforgiving the market has become. The stock dropped more than 10% following earnings, underscoring how even minor disappointments—especially in cloud growth—can trigger outsized reactions. Microsoft’s performance serves as a cautionary reference point for Amazon, particularly around AWS growth comparisons with Azure.

Tesla (TSLA)

Tesla stands out slightly among mega-caps, posting a modest gain of around 5% over the past year. However, this performance still pales in comparison to index returns. Tesla’s inclusion in the broader discussion highlights that even companies perceived as high-growth innovators have struggled to materially outperform in the current macro and rate environment.

Alphabet / Google (GOOGL)

Alphabet presents a stark contrast to Amazon on a longer time horizon. Over the past five years, Alphabet’s stock is up more than 200%, far exceeding Amazon’s roughly 33% gain over the same period. Alphabet’s aggressive capital expenditure plans—estimated at around $160 billion—are largely focused on AI and custom silicon, benefiting partners like Broadcom. This comparison reinforces investor expectations that sustained innovation and margin expansion must translate into stock performance.

NVIDIA (NVDA)

NVIDIA remains a key supplier of GPUs to hyperscalers, including Amazon, Microsoft, and others. While not the primary focus of the discussion, NVIDIA’s role is central to cloud margins, as reliance on third-party GPUs can pressure profitability. Amazon’s push toward in-house chips is partly aimed at reducing long-term dependence on NVIDIA hardware.

Advanced Micro Devices (AMD)

Advanced Micro Devices is another external chip supplier referenced in the context of cloud infrastructure. Like NVIDIA, AMD benefits from hyperscaler spending but also represents a cost center for cloud providers. Any reduction in reliance on third-party silicon could have long-term implications for AMD’s data-center growth trajectory.

Broadcom (AVGO)

Broadcom is positioned as a major beneficiary of AI-driven capital expenditure, particularly through custom ASICs used by Alphabet and others. Broadcom’s stock strength—rising even on down market days—reflects investor confidence that hyperscaler AI spending will continue at scale. While Amazon is less dependent on Broadcom than Alphabet, the company remains an important bellwether for AI infrastructure demand.

Marvell Technology (MRVL)

Marvell Technology is mentioned as a smaller player in the ASIC market. While it holds a more limited market share compared to Broadcom, Marvell still participates in the broader trend of custom silicon for AI and cloud workloads, making it a secondary but notable beneficiary of rising hyperscaler capex.

Nasdaq Composite (INDEX)

Nasdaq performance provides critical context for these individual stocks. Over the past year, the Nasdaq has risen approximately 15%, highlighting the extent to which many mega-cap technology companies—including Amazon—have underperformed the broader market. This divergence reinforces the idea that investors are no longer rewarding size alone, but are instead focused on growth rates, margins, and capital efficiency.