AI Winners and SaaS Losers? What AMD, AVGO, CRM, ADBE, NOW, MNDY, ASAN, and TEAM Reveal About Today’s Market

Enterprise software stocks show deep drawdowns but high projected upside, reflecting AI-driven disruption. Markets are split between momentum plays and contrarian bets on SaaS recovery.

Recent market action highlights a sharp divergence between semiconductor leaders AMD and AVGO and a broad selloff across enterprise software names CRM, ADBE, NOW, MNDY, ASAN, and TEAM. While semiconductors continue to benefit from sustained AI infrastructure demand, most SaaS companies have seen heavy valuation compression, with many trading at price levels last seen several years ago.

This contrast reflects a deeper shift in investor sentiment as AI agents, automation, and usage-based models challenge traditional seat-based enterprise software economics. The result is a market split between momentum-driven winners like AMD and AVGO, and deeply discounted enterprise platforms—CRM, ADBE, NOW, MNDY, ASAN, and TEAM—that now represent either compelling contrarian opportunities or ongoing structural risks.

Podcast

Market Volatility, Earnings Reactions, and the Enterprise Software Reckoning — on Apple and Spotify.

AMD — Advanced Micro Devices (AMD)

AMD reported strong earnings, beating both top-line and bottom-line expectations. Non-GAAP EPS exceeded estimates by roughly $0.21, and revenue beat expectations by a wide margin. Guidance for the next quarter was also raised.

Despite this, the stock fell over 8% in after-hours trading. This reaction isn’t unprecedented. AMD has enjoyed a massive run—up over 100% year-over-year—and the pullback appears driven more by valuation and expectations than fundamentals.

Key takeaways:

Long-term performance remains strong

Post-earnings volatility reflects profit-taking, not weak results

Prior earnings cycles show similar short-term swings with stabilization afterward

AVGO — Broadcom (AVGO)

Broadcom saw significant intraday volatility:

Opened around $335

Dropped to ~$309 (≈8% decline)

Recovered to close near $320

Trading volume spiked, signaling strong institutional participation. The price action reflects broader tech-sector weakness earlier in the day, followed by a late-session recovery as markets stabilized.

CRWV — CoreWeave (CRWV)

CoreWeave experienced one of the most dramatic intraday moves:

Fell roughly 7% by early afternoon

Rallied nearly 8% off the lows to close near $90

This kind of whipsaw price action underscores how high-beta, AI-adjacent stocks remain highly sensitive to broader market sentiment and intraday momentum shifts.

CRM — Salesforce (CRM)

Salesforce is now trading below $200, a level not seen in nearly three years. From a peak near $367 in late 2024, the stock has lost nearly 50% of its value.

Context:

The decline coincides with rising skepticism around enterprise AI monetization

Salesforce’s AI product, Agentforce, launched in 2024, initially boosted sentiment

Reality appears to have set in around pricing, adoption, and perceived value

Despite the selloff:

Forward P/E is under 20

Analyst forecasts still show ~18% upside over 12 months

Earnings are approaching, which could reset expectations

ADBE — Adobe (ADBE)

Adobe is now trading at price levels last seen 6–7 years ago. The stock has lost nearly half its value over the past five years.

Key observations:

Forward P/E near 12 suggests deep multiple compression

Short interest near 3% indicates ongoing bearish sentiment

Analysts project ~60% upside over the next year

Competitive pressure from generative AI tools—especially from large platform players—has fundamentally changed how investors view Adobe’s moat.

NOW — ServiceNow (NOW)

ServiceNow has fallen nearly 50% over the past year, returning to price levels from roughly 2.5 years ago.

Highlights:

Forward P/E around 28

Short interest under 2%

Analysts project ~75% upside over 12 months

Like Salesforce and Adobe, ServiceNow illustrates the broader market’s discomfort with traditional enterprise SaaS valuations in an AI-driven productivity world.

MNDY — Monday.com (MNDY)

Monday.com has been one of the hardest-hit names:

Down ~60% year-over-year

Fell from ~$320 to near $100

Despite this:

Short interest is elevated (~8%)

Earnings are imminent

Analysts project over 100% upside, even on conservative estimates

The stock reflects extreme sentiment compression ahead of a potential inflection point.

ASAN — Asana (ASAN)

Asana has lost over 90% from peak levels and is trading near all-time lows.

Key data points:

Still down ~50–60% over the last few years

Short interest above 13%

Analysts project ~60% upside with meaningful risk

Asana exemplifies how smaller enterprise software players have been disproportionately affected by AI-driven workflow shifts.

TEAM — Atlassian (TEAM)

Atlassian mirrors Asana’s trajectory:

Down over 65% from recent highs

Trading at price levels from ~6 years ago

Despite the drawdown:

Analysts project over 100% upside

Lower-end targets still imply ~40% appreciation

The similarity between TEAM and ASAN price charts highlights sector-wide repricing rather than company-specific collapse.

Macro Takeaway: Why Enterprise Software Is Under Pressure

Across Salesforce, Adobe, ServiceNow, Atlassian, Asana, and Monday.com, a consistent pattern emerges:

AI tools and agents reduce seat-based SaaS dependency

Companies are shrinking headcount, reducing per-seat licensing revenue

Low-code and “vibe coding” enable teams to replace off-the-shelf tools with custom solutions

Capital is flowing toward AI infrastructure, not traditional SaaS

This has created a valuation reset, not necessarily a death spiral.

Charts

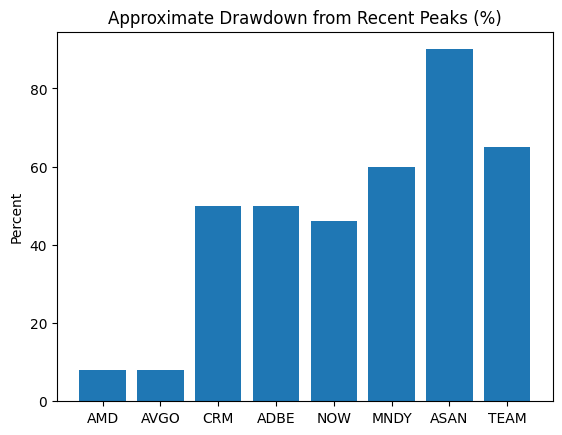

📉 Chart 1: Approximate Drawdown from Recent Peaks (%)

What it shows

How much each ticker has fallen from recent highs

Makes the enterprise software vs semis contrast obvious in one glance

Key insight

AMD and Broadcom are down single digits

Enterprise software names cluster between 45%–90% drawdowns

Asana and Atlassian clearly stand out as extreme repricing cases

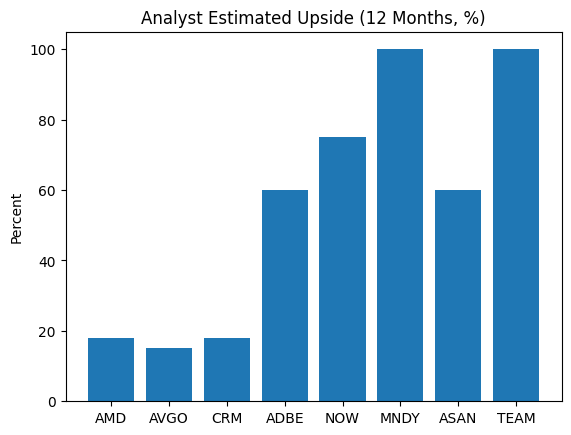

📈 Chart 2: Analyst Estimated Upside (Next 12 Months, %)

What it shows

Street consensus upside expectations discussed in the episode

Highlights the disconnect between current price pain and future expectations

Key insight

The hardest-hit stocks (MNDY, TEAM, ASAN) show the largest forecasted upside

Semis (AMD, AVGO) look comparatively “fully valued”

Classic risk vs reward bifurcation in the market

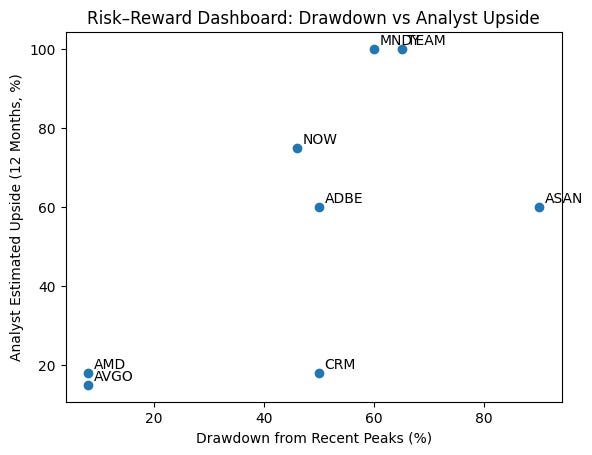

📊 Risk–Reward Dashboard: Drawdown vs Analyst Upside

How to read it

X-axis (left → right): How far the stock is down from recent peaks

Y-axis (bottom → top): Analyst-estimated upside over the next 12 months

Each dot = one ticker

Think of it as a risk–reward map.

Final Thought

Investors face a clear fork in the road:

Contrarian view: These stocks are historically cheap and offer asymmetric upside if enterprise software adapts successfully to AI

Momentum view: Capital remains better allocated to semiconductors, energy, and AI infrastructure where growth is visible today

Either way, the enterprise software sector is at a genuine inflection point.